costa rica taxes for canadian expats

The region is centred around the capital of the country San. Costa Rica is a relatively safe eco-friendly expat-friendly destination with gorgeous beaches and friendly locals.

Living In Costa Rica As An Expat Full Fact Guide Expatra

What Other Types of Taxation Does Costa Rica Have.

. Expats in Costa Rica love the Pura Vita vibe Costa Ricans focus of family and friendship and being surrounded by nature. Income taxes for tax residents in Costa Rica are set at a progressive rate which range from 0 percent to 25 percent. Costa Rica income tax rates are progressive between 0-25.

Costa Rica versus Panama a Comparison for Expats. Active companies pay 25 of Costa. The Central Valley is a favourite Costa Rican destination for expats.

Meet other Canadians at our events in Costa Rica. 10 Tips for Living in Costa Rica. Best Places to Live in Costa Rica.

However if youre a non-tax resident your income tax rate. This week I had the pleasure of speaking with Arun Ernie Nagratha CPA CA CPA of Trowbridge Professional Chartered Accountants and Tax Advisors to discuss Canadian taxes for expats. Income tax on wages and income tax on profit generating.

Income subject to tax in this country includes employment income self-employment business income investment income directors fees and capital gains. Latest News Relating to Costa Rica or Canada. Both are popular expat locations and both have pros and cons.

Canadian pundits expect expat exodus from Hong Kong. Costa Rica has a lot to offer expats with its tropical climate eco-friendly culture beautiful beaches welcoming people good healthcare system. It is not an income tax but just a charge by the government for using a company structure to hold assets instead of in a personal name.

Canadian pundits expect expat exodus from Hong Kong. As the Hong Kong protests against Chinas extradition bill continue China watchers in. The Central Valley.

So this isnt really good or bad news for tourists but its good news for Canadian expats and immigrants. Furthermore there is no capital gains tax and annual property tax is. Costa Rica didnt have a capital gains tax except for developers until 2019.

Can you live in Costa. However if youre a non-tax resident your income tax rate will fixed at either. People ask all the time about Panama as the new Costa Rica.

The capital gains charge is 15 for residential properties and 30 for commercial properties. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. The Costa Rican sales tax is.

Attend our monthly events and activities for Canadians expatriates to get to know like-minded expatriates in real life. There are 2 different types of income taxes in Costa Rica. Meet Jason Canadian Expat in Costa Rica.

How Much Money Do You Need To Move To Costa Rica Earth Relocation

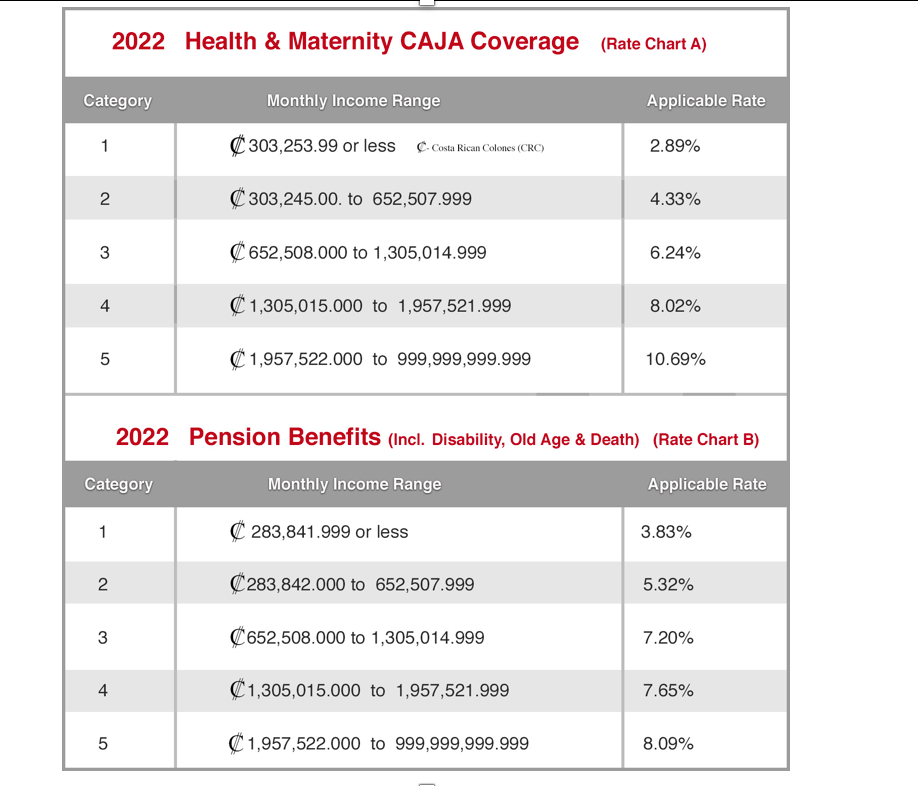

Caja Costs Spike For Expats In Costa Rica Costa Rica Star News

The Dark Side Of Costa Rica Why Expats Leave Badass Digital Nomads

Country Of The Month Costa Rica Advisor S Edge

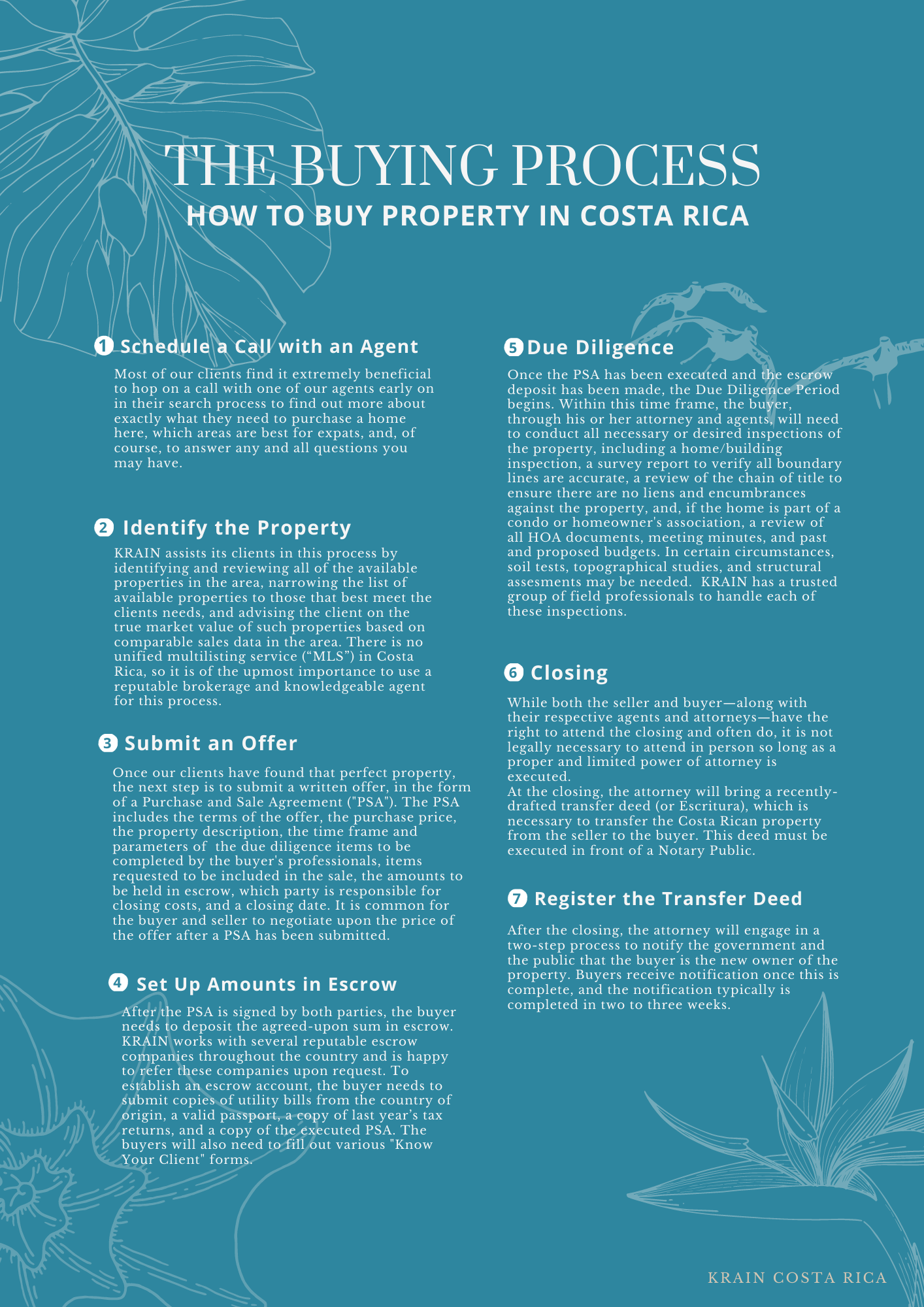

How To Relocate To And Set Up Your Life In Costa Rica

Moving To Costa Rica The Ultimate Guide Moving Com

5 Tips For Canadian Retirees Moving To Costa Rica Costa Rica Mls

How To Retire In Costa Rica From Canada 4 Simple Steps

Costa Rica Or Panama Which Is A Better Choice For You

Questions About Moving To Costa Rica

The Taxation System In Costa Rica Guide Expat Com

Costa Rica Living Life News Blog Reviews Comments

Expat Tax Questions Canadians Working Abroad Asked 5 Questions Youtube

Canadian Expat And Nomad Taxes Changes Coming Adam Fayed

The Safest Places To Live In Costa Rica An Expat S Guide

Canadian Expats Archives Adam Fayed

Retire In Costa Rica Best Places Costs Social Security Residency Taxes Playas Del Coco Properties Costa Rica Real Estate